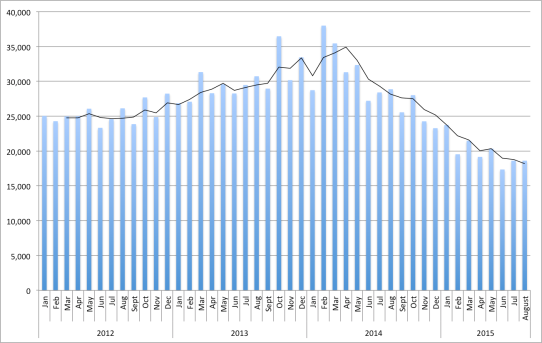

The Macau gaming stocks have been smashed in the last 18 months, down 70% in certain cases. The following chart, which shows the Macau Gross Gaming Revenue (in units of MOP million) as published by Macau’s Gaming Inspection and Coordination Bureau, shows the underlying problem: since early 2014, the total Macau gaming revenue has dropped nearly 50% due to the ongoing corruption crackdown in China that has sent many high-rollers into hiding. So casino earnings are down across the board, and the recent stock market rupture served to compress the earnings multiple even further.

Is now a good time to buy from Mr Market?

Many of the Macau casino stocks still trade at a relatively high multiple of this year’s (depressed) earnings so, if one is particularly pessimistic about Macau’s future, there’s still good reason to sit on the sideline. Among the carnage, one stock stood out as particularly neglected: SJM Holdings. Let’s look at some facts:

- SJM Holdings has a current market capitalisation of HKD 36.5 billion (as of 2 Sep 2015).

- The balance sheet is in pristine condition, with HKD 22.8 billion in cash and equivalents currently earmarked for the development of Lisboa Palace at Cotai, due to open in 2017.

- On revenue of HKD 26.6 billion, the company made a net profit of HKD 1.79 billion in the first 6 months of 2015 and will be paying out a third of that in interim dividends.

- SJM Holdings held on to 22.3% market share of the total Macau gaming revenue in the first 6 months of 2015, although that is expected to decline as new casinos and integrated resorts open in the rest of 2015 and 2016.

Looking more broadly at the industry, there is general agreement (at least among value investors) that Macau gaming revenue will recover at some stage, especially with the major infrastructure projects, including the Hong Kong-Zhuhai-Macau Bridge, being developed that will vastly improve Macau’s accessibility when they are completed. With Macau likely to remain the only place in China where legalised gambling is allowed in the near future, a bet on Macau today is a bet on two things: 1) the Chinese middle-class will continue to grow and get richer; 2) the Chinese affinity for gambling will continue unabated like it has for thousands of years. These are by no means sure bets, but one has to like the probability. So the gaming revenue is expected to recover at some stage and perhaps grow more from there; the only problem is that no one really knows when that will happen.

Let’s now do a simple back-of-the-envelope valuation exercise on SJM Holdings.

Backing out the HKD 22.8 billion in cash, SJM has a current enterprise value of HKD 13.7 billion, which means it’s currently trading at 3.8 times this year’s estimated net profit. 3.8 times! Or equivalently, 26% earnings yield. Earnings on the existing casinos can fall another 50% and the valuation would still make sense, given that most of the earnings come out as cash that can be distributed. This is assuming the ~HKD 25 billion being poured into the development of Lisboa Palace at Cotai will not end up being mostly wasted. So is that a risk?

The near worst-case scenario is that the general Macau gaming revenue will stay at the current low level forever and that, instead of contributing to new revenue, Lisboa Palace will serve only to help SJM hang on to its existing market share of around 20-23% of total Macau gaming revenue. This scenario is possible, but not probable. In this case, we are paying a PE of around 10-12 future earnings for SJM Holdings at the current price of ~HKD 6.50 per share, hardly a disaster.

Anything better than the dire scenario painted above and the stock will turn out to be good investment.

The fact that SJM Holdings is late to the game of developing a new casino resort may turn out to benefit shareholders after all: the bulk of the money is not yet spent and if it turns out that the industry will slump further, SJM has the option of not proceeding with Lisboa Palace and may even be able to make an opportunistic acquisition with its cash pile!

This cloud will take time to clear, but one is paid a fair yield of 4-5% at today’s price to be patient.

One thought on “SJM Holdings — A Value Play”